Navigating Natural Gas Volatility: Strategies for Profitable Trading

Explore key strategies for profitable natural gas trading, tackling volatility with effective risk management for short and long-term success.

Introduction to Natural Gas Volatility

Natural gas stands as a cornerstone in the energy sector, characterized by its significant volatility which presents both risks and opportunities for traders. This introduction explores the factors influencing natural gas volatility, including seasonal demand shifts, geopolitical events, and technological changes, setting the stage for understanding the dynamic market landscape.

The Basics of Trading Natural Gas

Trading natural gas requires familiarity with the market's key players, including producers, consumers, and speculators, as well as the platforms and tools essential for executing trades. This section lays the groundwork for newcomers, detailing the essentials needed to navigate the natural gas market effectively.

Short-Term Trading Strategies

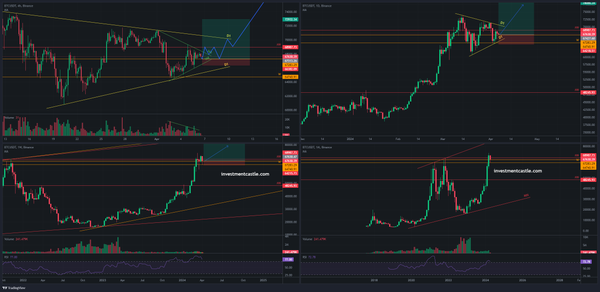

For traders aiming to capitalize on short-term fluctuations in natural gas prices, this segment offers insight into day trading tactics and the role of technical analysis. Strategies discussed will include leveraging charts and indicators to time trades and maximize profits amidst daily volatility.

Long-Term Trading Approaches

Long-term trading in the natural gas market involves a different set of strategies focused on fundamental analysis, diversification, and portfolio management. This part delves into how to build a resilient investment in natural gas that can weather volatility and yield returns over time.

Risk Management in Natural Gas Trading

Effective risk management is crucial in trading natural gas due to its unpredictable price swings. Techniques for setting stop losses and using leverage wisely are covered, providing traders with tools to protect their capital while pursuing profitability.

Analyzing Market Indicators for Natural Gas

Understanding the supply and demand dynamics, alongside external factors such as weather patterns and economic reports, is vital for natural gas traders. This section explains how to interpret these indicators to make informed trading decisions.

Leveraging Volatility for Profit

Volatility in natural gas can be a double-edged sword. Here, we discuss strategies to spot trading opportunities and time the market to take advantage of price movements, both upward and downward.

Case Studies: Successful Natural Gas Trades

Real-life examples of successful natural gas trades are presented, showcasing strategies that led to profitability in both short and long-term contexts. These case studies serve as practical illustrations of how theoretical strategies can be applied in the market.

Tools and Resources for Natural Gas Traders

A compilation of software, platforms, and educational resources recommended for traders looking to excel in the natural gas market. This guide aims to equip traders with the knowledge and tools necessary for successful trading.

Common Pitfalls in Natural Gas Trading

Awareness of common mistakes in natural gas trading, such as emotional decision-making and overleveraging, can help traders avoid costly errors. This section offers advice on steering clear of these pitfalls.

Future Trends in Natural Gas Markets

Insight into the potential future trends affecting the natural gas market, including environmental policy shifts and technological advancements, prepares traders for what lies ahead, enabling forward-looking strategy development.

Frequently Asked Questions

What causes natural gas prices to be so volatile?

Natural gas prices are notably volatile due to a combination of factors. These include seasonal demand variations, with higher consumption in winter for heating and summer for cooling, storage levels, production rates, and infrastructure constraints that can limit supply. Additionally, geopolitical events, technological advancements, and changes in regulatory policies can also cause significant price fluctuations. This volatility is a double-edged sword, presenting risks as well as opportunities for traders.

How can I start trading natural gas as a beginner?

Starting to trade natural gas as a beginner involves several steps. First, educate yourself on the natural gas market, including its drivers and terminologies. Next, choose a reputable broker that offers commodities trading and open a trading account. It's also advisable to start with a demo account to practice trading strategies without financial risk. Finally, develop a trading plan that includes clear goals, risk management rules, and a decision-making process. Staying informed about market trends and continuously learning from both successes and failures is crucial for ongoing improvement.

What are the best indicators for trading natural gas?

The best indicators for trading natural gas can vary based on your trading strategy and market conditions. However, common technical indicators include moving averages to identify trends, the Relative Strength Index (RSI) for overbought or oversold conditions, and Bollinger Bands to gauge market volatility. Fundamental indicators, such as inventory reports from the Energy Information Administration (EIA), weather forecasts, and economic indicators, are also vital as they directly affect supply and demand dynamics.

Can weather forecasts really affect natural gas trading?

Yes, weather forecasts can significantly affect natural gas trading. Natural gas is heavily used for heating and cooling, so demand spikes in extreme cold or hot weather. Traders closely monitor weather forecasts to anticipate changes in demand and adjust their trading strategies accordingly. For instance, a forecasted cold winter can lead to expectations of increased heating demand, potentially driving prices up. Similarly, mild weather can reduce demand, leading to lower prices.

How do geopolitical events impact natural gas prices?

Geopolitical events can have a profound impact on natural gas prices by affecting supply and demand dynamics. Conflicts, sanctions, and political instability in key natural gas-producing regions can disrupt supply chains and reduce production. Conversely, agreements and policies that facilitate the development of natural gas infrastructure or increase supply can lower prices. Traders must stay informed about global events, as these can lead to sudden and significant price movements.

Conclusion

Trading natural gas profitably amidst its inherent volatility requires a blend of strategic planning, risk management, and ongoing education. By applying the strategies and principles outlined in this guide, traders can navigate the ups and downs of the market, positioning themselves for both short and long-term success.